The Best Guide To Medicare Graham

The Best Guide To Medicare Graham

Blog Article

The Ultimate Guide To Medicare Graham

Table of ContentsFascination About Medicare GrahamThe Best Guide To Medicare GrahamThe smart Trick of Medicare Graham That Nobody is DiscussingThe smart Trick of Medicare Graham That Nobody is Talking AboutMedicare Graham - The Facts

Before we chat concerning what to ask, let's chat concerning who to ask. For numerous, their Medicare trip begins directly with , the official website run by The Centers for Medicare and Medicaid Providers.

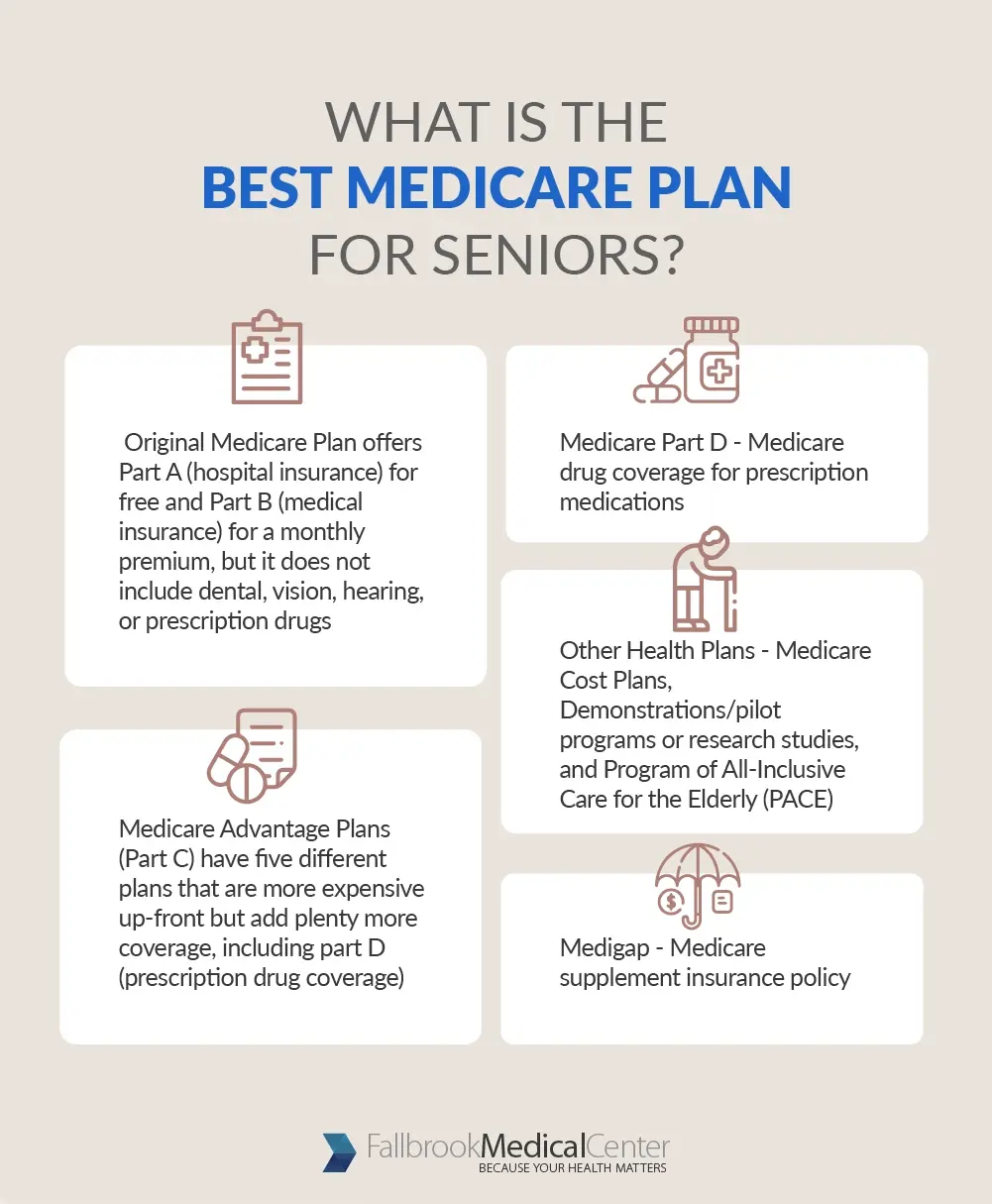

It covers Component A (medical facility insurance coverage) and Component B (medical insurance policy). These strategies work as an alternate to Initial Medicare while using even more advantages.

Medicare Part D plans assistance cover the expense of the prescription medicines you take at home, like your day-to-day medicines. You can sign up in a separate Component D strategy to add drug insurance coverage to Original Medicare, a Medicare Expense plan or a few other types of plans. For many, this is usually the very first inquiry taken into consideration when looking for a Medicare plan.

Medicare Graham - The Facts

To get the most economical health treatment, you'll desire all the services you make use of to be covered by your Medicare plan. Your plan pays everything.

and seeing a copyright who accepts Medicare. What regarding taking a trip abroad? Numerous Medicare Advantage plans provide international protection, as well as insurance coverage while you're traveling domestically. If you intend on taking a trip, ensure to ask your Medicare expert about what is and isn't covered. Maybe you've been with your existing medical professional for some time, and you intend to maintain seeing them.

The Best Guide To Medicare Graham

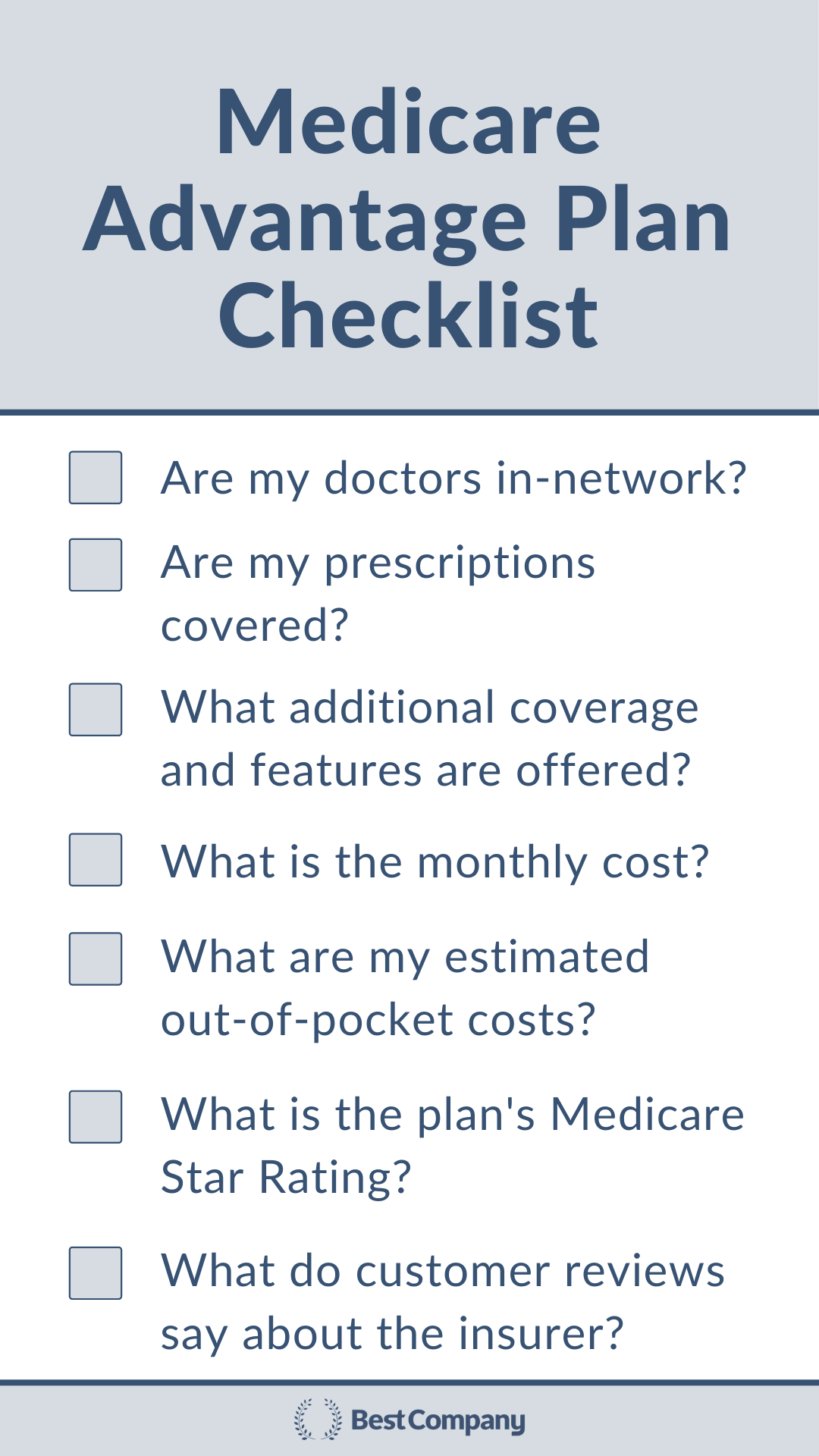

Lots of people that make the switch to Medicare continue seeing their regular doctor, but also for some, it's not that simple. If you're dealing with a Medicare consultant, you can ask if your doctor will be in network with your brand-new strategy. Yet if you're checking out strategies independently, you might have to click some web links and make some phone calls.

For Medicare Advantage strategies and Cost strategies, you can call the insurer to ensure the doctors you wish to see are covered by the strategy you have an interest in. You can likewise check the plan's site to see if they have an online search device to find a covered physician or facility.

Which Medicare strategy should you go with? That's the most effective part you have alternatives. And eventually, the selection depends on you. Remember, when starting, it is necessary to make certain you're as informed as possible. Start with a checklist of factors to consider, ensure you're asking the ideal questions and begin concentrating on what sort of plan will best serve you and your demands.

What Does Medicare Graham Mean?

Are you about to turn 65 and become newly qualified for Medicare? The least costly plan is not always the ideal choice, and neither is the most expensive strategy.

Also if you are 65 and still functioning, Learn More it's a great concept to evaluate your alternatives. Individuals receiving Social Safety benefits when turning 65 will certainly be immediately registered in Medicare Components A and B. Based upon your work circumstance and healthcare alternatives, you may require to take into consideration signing up in Medicare.

Consider the various kinds of Medicare plans readily available. Original Medicare has two parts: Component A covers hospitalization and Component B covers clinical costs. Lots of individuals locate that Parts A and B with each other still leave gaps in what is covered, so they purchase a Medicare supplement (or Medigap) strategy.

Medicare Graham Fundamentals Explained

There is usually a costs for Part C plans in addition to the Component B premium, although some Medicare Advantage plans offer zero-premium strategies. Medicare Lake Worth Beach. Review the coverage details, prices, and any type of added advantages offered by each plan you're taking into consideration. If you sign up in initial Medicare (Parts A and B), your premiums and protection will coincide as other individuals that have Medicare

(https://www.40billion.com/profile/334922652)This is a fixed quantity you may have to pay as your share of the price for treatment. A copayment is a set amount, like $30. This is the most a Medicare Advantage participant will certainly need to pay out-of-pocket for covered solutions each year. The quantity varies by plan, once you get to that restriction, you'll pay absolutely nothing for protected Part A and Part B solutions for the remainder of the year.

Report this page